Submitting a predetermination

A predetermination request relates solely to services that have not yet been rendered. It is a request to obtain the amount that the insurer would pay if these services were provided on that same day. You should not submit a predetermination request if the service has already been provided; in this case submit a claim.

Note that the Payable to field is not available for predetermination requests, and online predetermination requests are not supported by all participating insurance companies.

Predeterminations are not available in the eClaims mobile app.

There are four steps to creating a predetermination:

Note: In some cases, an insurer may block eClaims from being submitted electronically. For more information, see Claim blocked by insurer.

After you submit a predetermination, you can copy it to a new claim as described in Submitting a claim by copying a previous claim or predetermination.

Note: If at any point you want to return to a previous screen, select the appropriate Back link to the left of the screen you are working on rather than using the browser's back button. For example, from the Service information screen, you can go Back to Patient Information.

Note: You may also choose to Cancel claimor Save draft & exit or Cancel claim. Drafts are available for 30 days. For information on resuming work on a draft claim, see Continuing a draft claim.

1. Select the participating insurer and service provider

-

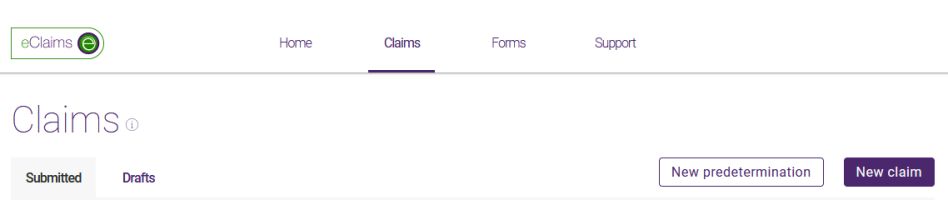

From the eClaims application, select the Claims tab, then select New predetermination.

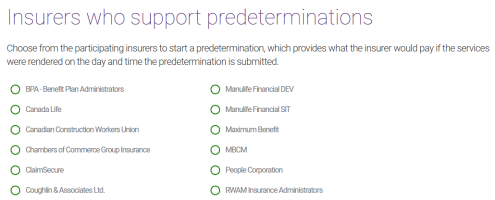

The insurers that support predeterminations are displayed.

-

Select the applicable insurer, then select Continue to Provider information.

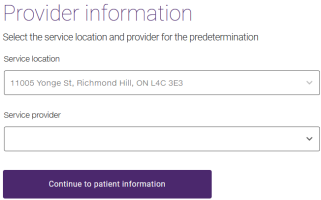

The Provider information page is displayed.

-

If your organization has registered with TELUS to provide services from multiple locations, select the Service location.

To filter the list of service locations, enter the first few characters of the address.

-

Select the Service provider.

To filter the list of service providers, enter the first few characters of the provider's name.

2. Select or create the patient

-

Select Continue to Patient information.

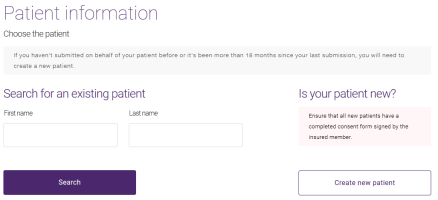

The Patient information page is displayed.

-

To select an existing patient, see 2a. Select an existing patient

To create a new patient, see 2b. Create a new patient

2a. Select an existing patient

-

In the Search for existing patient section, enter at least two characters in either the First name or Last name field.

-

Select Search.

If you get too many search results, refine your search by entering the full patient name.

The matching patients are displayed.

-

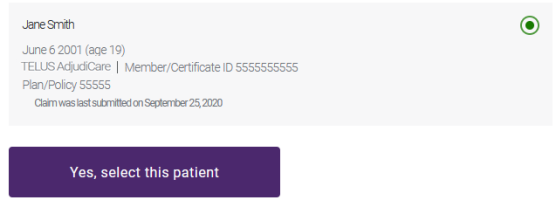

Select a patient.

-

Select Yes, select this patient.

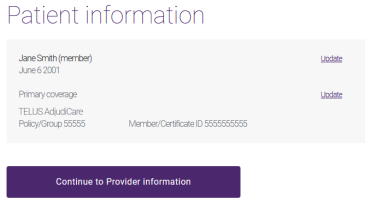

The Patient information page is displayed.

-

Verify the information of the patient you selected.

-

If you need to change it, select the applicable Update link, then make the applicable changes and select Update.

2b. Create a new patient

-

Select Create new patient.

The Patient information page is displayed.

-

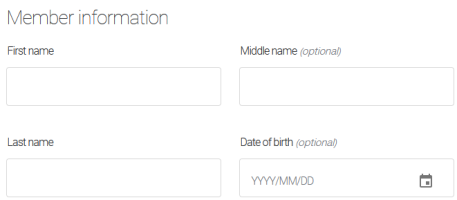

Enter the patient's First name, optional Middle name, and Last name.

-

Select their Date of birth.

The Insurer is pre-filled based on the previous window.

-

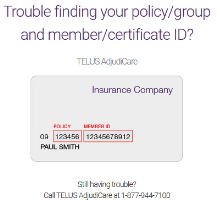

Enter the patient's Policy / Group and Member / Certificate ID.

If you have trouble locating either of these numbers, select either What's this? link to display an image that identifies the location of the numbers on the insurer card.

-

Select the Patient relationship to member.

-

Insured Member: The patient and the person who holds the coverage are the same person.

-

Spouse: The patient is the spouse of the person who holds the coverage.

-

Child: The patient is a child of the person who holds the coverage

-

Handicapped Dependent: The patient is a handicapped child of the person who holds the coverage

-

Part Time Student: The patient is a part-time student at a post-secondary institution and a child of the person who holds the coverage.

-

Full Time Student: The patient is a full-time student at a post-secondary institution and a child of the person who holds the coverage.

-

Domestic Partner: The patient cohabits with the person who holds the coverage but is not considered the person’s spouse.

-

Enter the member's First name, optional Middle name, and Last name.

-

Select their Date of birth.

-

-

If the patient has additional coverage, do the following:

-

Drag the Secondary coverage slider to the right.

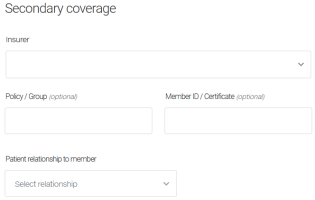

The Secondary coverage section is displayed.

-

Select an Insurer.

If your patient has secondary coverage but this insurer is not listed, select Other Health Care Insurance Company.

-

Optionally enter the member's Policy / Group and Member ID /Certificate.

If you have trouble locating either of these numbers, select either What's this link to display an image that identifies the location of the numbers on the insurer card.

-

Select the Patient relationship to member.

If you select any relationship other than Insured Member, a Member Information section is displayed:

-

Enter the member's First name, optional Middle name, and Last name.

-

Select their Date of birth.

-

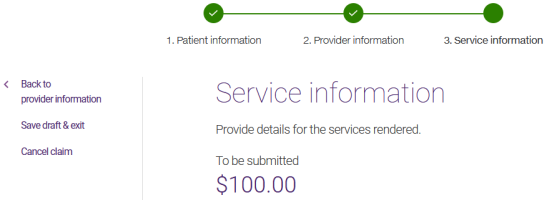

3. Enter the service information

-

Select Continue to service information.

The Service information page is displayed.

Its appearance varies depending on the provider type. For example, for time-based services, a Duration field is present. For optometry services, Purpose and eye fields are present.

-

Select the Date of service, if it differs from the current date.

-

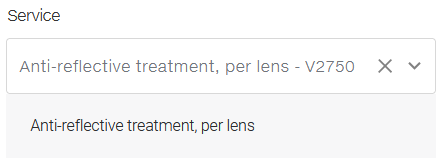

Select the Service.

The selected service and service code are displayed beneath the Service drop-down list.

-

If the service is not time-based, change the Quantity value to a number larger than one.

This reflects the number of times the service code is being claimed on that date. For example, if the service represents a treatment, enter the number of treatments received on the date specified; if the service code represents X-rays, enter the number of films (or views) being claimed; if lenses are claimed, enter the number of lenses being claimed. For vision claims, the quantity should also reflect the number of times the service code is being claimed on that date.

If the Quantity is set to ‘1’, the services performed are time-based. Enter a value in the Duration field, in the next step.

-

In the Duration field, optionally enter the number of minutes that the visit took, when available.

-

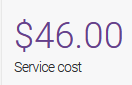

Enter the Cost per item.

The Service cost (in the upper right hand corner) is updated. If a Quantity was entered, this value will represent the quantity multiplied by the Cost per item.

-

Optionally select the Purpose.

The insurance company may need to use this information to verify if the service is covered. The possible values are:

-

Initial prescription: the service is due to an initial vision care prescription.

-

Changed prescription: the service is due to a change in the prescription.

-

Lost or broken: the service was the result of a lost or broken item such as glasses.

-

Refill prescription: the service was the result of refilling a prescription.

-

Other: use this value if the purpose or reason for the service is not listed.

-

-

If a vision care service affects one eye only, select either Left or Right.

-

Repeat steps 2 to 8 as many times as necessary to add all of the services.

-

If the service was not rendered In person, at the clinic, select either In person, at patient's location or Virtually.

-

If the patient's injury was caused by an accident:

-

Drag the Injury caused by an accident slider to the right.

Two additional fields are displayed:

-

Select the applicable Accident Type: Motor vehicle, Workspace, or Other.

-

Select the Date of Accident.

-

-

If the service will be given as a result of a prescription or referral by a physician:

-

Drag the Physician referral slider to the right.

Up to four additional fields are displayed, depending on the insurer you selected:

-

Select the Prescriber type.

-

Enter the Physician first name and Physician last name.

-

If you selected Beneva Inc., Canada Life, Canada Life - PSHCP, Desjardins Insurance, or UV Insurance as an insurer, optionally select the Referral date. This field is hidden for other insurers.

-

-

-

If the claim is for physiotherapy services, the Is provincial insurance exhausted? question is displayed. Depending on the provincial government healthcare plan of the province where the patient is covered, it may be necessary for you to indicate if the coverage by the provincial healthcare plan has been fully exhausted. If this is the case, drag the the Is provincial insurance exhausted? slider to the right.

In certain provinces, it is not permitted to submit healthcare expenses covered by the provincial plan to a private healthcare insurance company until the provincial coverage has been fully exhausted.

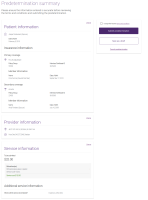

4. Verify and submit the predetermination

-

Select Continue to Claim summary.

The Predetermination summary is displayed.

-

Verify the information you entered.

If you need to change it, select the applicable Change link, then make the applicable changes and select Update.

-

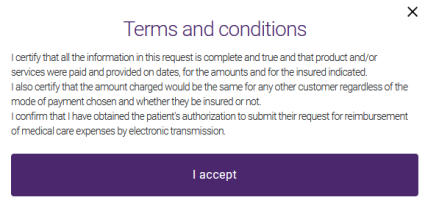

Select the terms and conditions link to display these in a pop-up.

-

To accept the terms and conditions, select the I accept button on the pop-up or select the checkbox on the Claim summary.

-

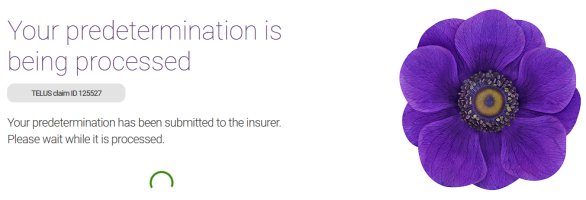

Select Submit predetermination.

A claim processing message is displayed.

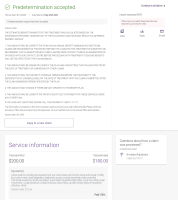

A response is returned. If the predetermination was successfully processed, the Predetermination accepted response is displayed.

For information on responses, see Viewing, printing, saving, and emailing responses.

Related info

Related info

Submitting a claim by copying a previous claim or predetermination